Introduction: Why Financial Analyst Salaries Differ So Widely Across Regions

The role of a Financial Analyst exists in almost every modern economy, yet salary levels vary dramatically between Europe and North America.

Two professionals with the same title may earn vastly different incomes depending on:

- the financial system they operate in

- the type of employer (corporate, bank, asset manager, public sector)

- regulatory complexity

- bonus culture and performance incentives

- cost of living and taxation

This guide provides a system-level comparison of financial analyst salaries across Europe and North America, focusing on:

- realistic base salary ranges

- bonus structures and total compensation

- experience-level progression

- industry and employer differences

- regional pay patterns

- long-term earning potential

This is a salary intelligence report, not a simple list of averages.

1. What Does a Financial Analyst Do?

Across Europe and North America, a Financial Analyst is responsible for analyzing financial data to support decision-making.

Common responsibilities include:

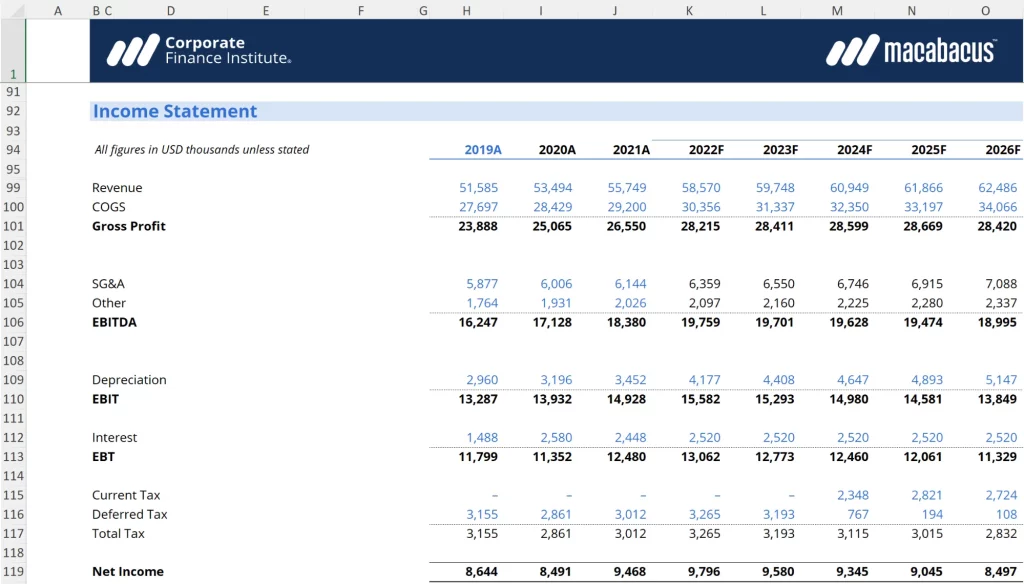

- financial modeling and forecasting

- budgeting and variance analysis

- evaluating investments and capital projects

- analyzing company performance and financial statements

- supporting management, investors, or clients with data-driven insights

While the title is similar globally, the economic value of the role varies significantly by market and employer.

2. Financial Analyst Salary Overview: Europe vs North America

High-Level Comparison (Base Salary Focus)

| Region | Typical Annual Base Salary Range |

|---|---|

| United States | $70,000 – $110,000 |

| Canada | $65,000 – $95,000 |

| United Kingdom | £35,000 – £65,000 |

| Western Europe (EU) | €40,000 – €75,000 |

| Northern Europe | €50,000 – €85,000 |

These ranges reflect typical corporate and banking roles, excluding extreme outliers in investment banking or hedge funds.

3. Financial Analyst Salary by Experience Level

Entry-Level Financial Analyst (0–2 Years)

- Typical focus: reporting, data preparation, basic models

- Common employers: corporations, banks, consulting firms

Typical base pay:

- North America: $60,000 – $75,000

- Europe: €35,000 – €50,000

At this stage, brand name employers and training quality matter more than immediate salary.

Mid-Level Financial Analyst (3–6 Years)

- Owns forecasts, models, and business cases

- Interfaces directly with management or clients

Typical base pay:

- North America: $80,000 – $105,000

- Europe: €50,000 – €70,000

This is the phase where career trajectory diverges sharply depending on industry and specialization.

Senior Financial Analyst (7–12 Years)

- Leads complex analyses

- Often mentors junior analysts

- Plays a strategic role in planning

Typical base pay:

- North America: $95,000 – $130,000

- Europe: €65,000 – €90,000

At senior levels, bonuses and incentives become increasingly important.

4. Industry-Based Salary Differences

Corporate Finance (FP&A)

- Stable salaries

- Moderate bonuses (5–20%)

- Strong work-life balance relative to finance roles

Corporate FP&A roles dominate financial analyst employment across both regions.

Banking and Financial Institutions

- Higher base pay than corporate roles

- Bonuses vary widely by performance and role

- Greater regulatory pressure in Europe

In North America, bonuses are typically larger and more performance-driven.

Investment Management and Asset Management

- Higher upside

- Compensation strongly tied to market performance

- Fewer roles, higher competition

Total compensation can significantly exceed base salary in strong years.

Consulting and Advisory

- Competitive base salaries

- Project-based bonuses

- Faster skill accumulation

Consulting roles often serve as stepping stones to higher-paying finance careers.

5. Bonus Culture: A Key Difference Between Regions

One of the biggest pay differences between Europe and North America lies in bonus structures.

North America

- Bonuses are common and performance-driven

- Can represent 10–40% of total pay

- Less standardized, more negotiable

Europe

- Bonuses exist but are often smaller

- Stronger emphasis on fixed pay

- Regulatory caps affect some financial roles

As a result, North American analysts often experience higher income volatility but higher upside.

6. Financial Analyst Salary by Location

High-Paying Financial Hubs

| City | Typical Salary Level |

|---|---|

| New York | Very high |

| Toronto | High |

| London | High |

| Zurich | Very high |

| Frankfurt | Medium–High |

| Amsterdam | Medium–High |

Major financial centers pay more due to:

- concentration of capital

- complex financial products

- intense competition for talent

However, high living costs can offset nominal salary advantages.

7. Skills That Increase Financial Analyst Pay

Across regions, the following skills consistently increase earning potential:

- advanced financial modeling

- valuation and M&A analysis

- strong Excel and financial systems expertise

- understanding of regulatory frameworks

- ability to translate data into executive decisions

Professionals who combine technical accuracy with business judgment command the highest pay.

8. Certifications and Education Impact

Certifications can influence salary progression, especially in Europe:

- CFA (Chartered Financial Analyst)

- ACCA / CPA equivalents

- advanced degrees in finance or economics

In Europe, certifications often act as salary standardizers.

In North America, experience and performance tend to outweigh credentials more quickly.

9. Financial Analyst vs Accountant vs Investment Analyst

- Financial Analysts focus on forward-looking analysis

- Accountants focus on historical reporting and compliance

- Investment Analysts focus on asset valuation and markets

Investment-facing roles typically offer higher upside, but also higher risk and competition.

10. Long-Term Salary Outlook (2026 and Beyond)

Looking ahead:

- Demand for financial analysis remains strong

- Automation affects low-complexity reporting tasks

- Strategic finance roles become more valuable

- Business-facing analysts see the strongest salary growth

Financial analysts who move closer to decision-making and capital allocation enjoy better long-term income growth.

Final Thoughts: Is Financial Analysis a High-Income Career in Europe & North America?

Financial analysis offers:

- strong income stability

- clear progression paths

- portability across industries and countries

While it may not match elite investment banking pay, it provides reliable, scalable earning power across Europe and North America.

For professionals who continuously upgrade skills and move toward strategic roles, financial analysis remains a durable and respected finance career.

Leave a Reply